In the box at the bottom, where it says "Want to compare FHA against other low downpayment mortgage options?" click "Yes."Ĭonventional 97 mortgages require just 3 percent down and are available with no special restrictions all across the country. Now, compare FHA costs against another popular choice in the market, "Conventional 97" (3% down) financing. Once you've made your selections, costs for your FHA mortgage appear automatically on the right side of the screen.

Optionally, provide a guesstimate of what you think may happen to home values over the time period you entered in "compare costs over what number of years?" For low-downpayment mortgage products that require PMI, home price appreciation can speed up the time it takes to reach a point where you can cancel such a policy, trimming your monthly mortgage cost.

As you do, note that the calculations presented to the right change as you add or subtract years. Use the incrementer at the end of the field to add or subtract years. If your credit isn't so good, an FHA-backed mortgage might be your best option.įor "compare costs over what number of years?" indicate the period of time you expect to own your home. Although the FHA program does not use risk-based pricing that increases loan costs as your credit score declines, other low-downpayment choices in the market do, and it is these programs against which we compare costs for you.

In each of the ARM options, the interest rate remains fixed for the initial loan period, say five (or seven or ten) years, then adjusts every year for the remainder of the 20-year loan period.įor "credit rating," choose a score "bucket" from the dropdown that is closest to the one you think applies to you. Three varieties of hybrid adjustable rate mortgages (ARMs) can also be selected, including those with 5-, 7- and 10- year fixed-rate periods. For FRMs with terms of 20 years or less, select "FRM 20.01- yrs". Fixed-rate mortgages (FRMs) longer than 20 years should select "FRM 20.01+ yrs" this includes costs for 30-year FRM. In the dropdown, select "Yes" to finance it or "No" to pay it out-of-pocket.įor "product choice," please select among the five common options. If you prefer, you can pay the up-front MIP out-of-pocket for about 1.75% of the loan amount you are borrowing. Using your downpayment percentage, the calculator returns the dollar amount you'll need, which is based on the purchase price you entered.įor FHA programs, financing the up-front mortgage insurance premium is common to help buyers conserve funds. To start, add in the dollar amount of the home you hope to buy in the field for "purchase price." We supply a suggested interest rate for you, but if your rate is different, simply change it in the interest rate field.Ĭhoose your downpayment from the dropdown.

#Simple mortgage calculator with pmi how to

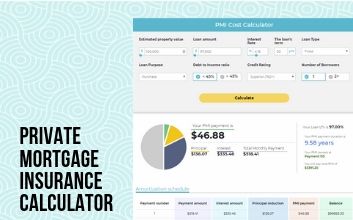

How to use HSH's FHA mortgage calculatorĬomparing low-downpayment-mortgage options is at the heart of this calculator. You'll learn exactly how each of these choices could affect your housing costs during the time you expect to own your home. Our calculator and low down-payment comparator enable you to compare these offerings on a side-by-side basis.

#Simple mortgage calculator with pmi mac

In recent years, Fannie Mae and Freddie Mac developed new products for low- and moderate-income buyers HomeReady and Home Possible (HR/HP) programs feature low (or no) risk-based add-ons to the rate or fees the borrower must pay and also reduced PMI premiums. These are subject to risk-based pricing adjustments that can raise the cost, making them less useful to borrowers with limited funds and lower credit scores. Fannie Mae and Freddie Mac have (almost) always backed low-downpayment mortgages called "Conventional 97s," where a borrower can place a downpayment as small as 3 percent. Unlike most traditional private mortgage insurance (PMI) policies, FHA uses an "amortized" premium structure, causing your MI costs to change over time as your loan balance declines.īorrowers with small downpayments aren't limited to an FHA-backed mortgage. It uses the formula provided by Housing and Urban Development (HUD) to properly calculate FHA mortgage insurance premium costs over time. This unique Federal Housing Administration (FHA) calculator accurately shows the costs of selecting an FHA-backed mortgage to finance your home.

0 kommentar(er)

0 kommentar(er)